Financial Planning for Real Estate Investors by Real Estate Investors

While most financial advisors focus on the stock and bond market, we realize that real estate holdings have a place on your balance sheet. Like yourself, our advisors are personally active in real estate investing, affording us “real-life” experience and knowledge on the ins and outs of buying, selling, and managing rental properties. We work with your CPAs, attorneys, and real estate agents, or you can access our team of trusted advisors familiar with the New Jersey market.

Because we have a combined experience of over 40 years investing in real estate, we provide first-hand knowledge of buying, selling, and managing rental properties. By integrating real estate holdings into your overall financial plan, you can possibly enhance returns, optimize tax benefits, and mitigate risks. Whether you’re an experienced investor or just starting, expert guidance helps navigate the complexities of real estate finance with confidence.

Our Financial Planning Services for Real Estate

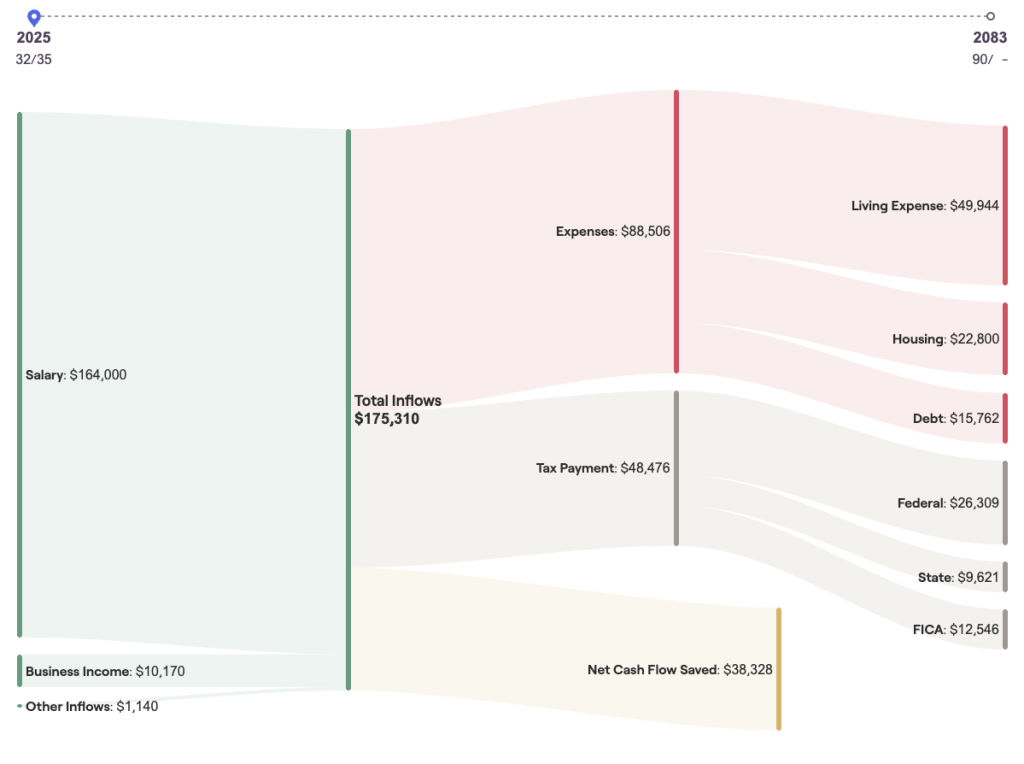

Cash Management

Maximizing cash flow is essential for successful real estate investing. We work with clients to optimize cash reserves that outperform most traditional banks while ensuring funds are allocated for capital expenditures, property acquisitions, and financial goals. Personalized budgeting tools provide insights into spending patterns, while strategic credit card recommendations maximize cashback rewards on both personal and business expenses.

Debt & Financing Analysis

Proper leverage is key to real estate success. We work with clients to assess debt risk tolerance, ensuring that property leverage aligns with overall investment strategy. Customized debt pay down plans help manage liabilities effectively. Credit utilization and financing options are also analyzed, providing personalized recommendations to improve credit scores and secure better loan terms for properties, businesses, or other major purchases.

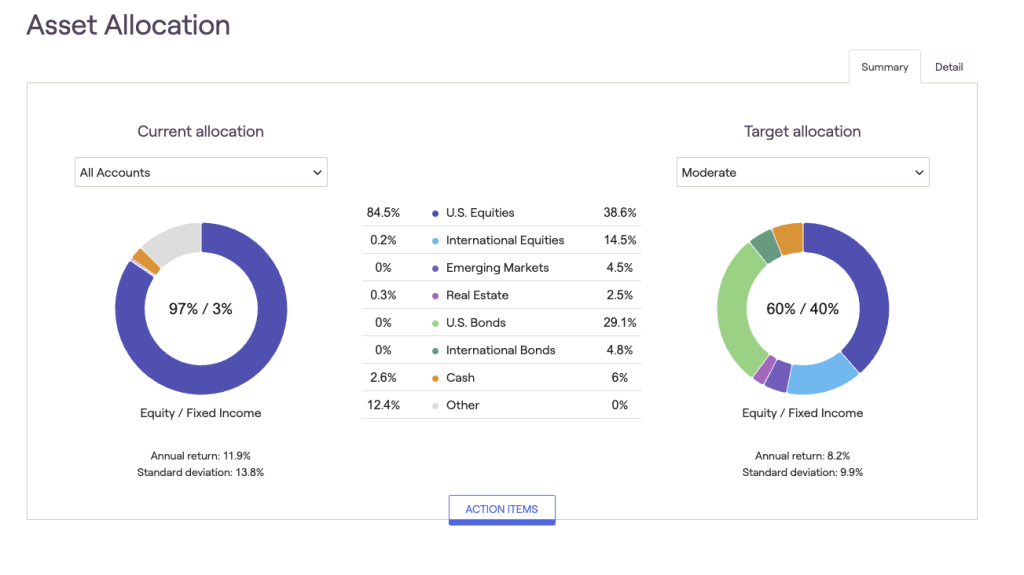

Investment Planning & Portfolio Management

Real estate and brokerage investments should work together for tax efficiency and wealth accumulation. Underperforming assets are identified and we advise and execute on strategies for potential sales or re-leveraging. Our advanced planning tools provide a clear visualization of how portfolio changes impact overall financial health.

Tax Planning

Real estate is one of the most tax-advantaged asset classes in the US. Depending on your goals, income, and needs we work with your accountant to put strategies in place to wipeout, defer, or minimize your tax liability.

Estate Planning

A well-structured estate plan ensures that real estate assets are protected and efficiently transferred to beneficiaries. Regular reviews of wills, trusts, and other estate documents keep them current, reflecting changes in executors, trustees, and beneficiaries. Durable Power of Attorney and healthcare proxies are also reviewed to ensure financial and medical decision-making authority is in place if needed.

Risk Management

Unexpected events can disrupt financial stability. We evaluate risks such as premature death, disability, and health-related expenses, developing strategies to safeguard financial goals. A cost-benefit analysis of health insurance options ensures minimized costs through real estate tax savings, while property and casualty insurance is reviewed to maximize coverage and reduce unnecessary expenses.

Technology-Driven Financial Management

A secure client portal provides real estate investors with a streamlined way to track financial progress:

- Monitor budgets, net worth, and spending categories

- Consolidate account balances, including investments, mortgages, and bank accounts

- Organize important financial documents like wills, trusts, and tax returns

- Stay on top of financial tasks with an action-item tracker

Who Benefits from Real Estate Financial Planning?

- House hackers

- Residential and commercial investors

- Investors accumulating or decumulating assets

- Aspiring real estate investors

- Property owners seeking to optimize financial strategies

Steps to Success for Real Estate Investors

- Define Your Financial Vision: Clarify Goals and Values Set clear investment goals. Do you want to build a real estate empire in New Jersey or simply have a stress-free retirement? Defining the vision sets a clear picture of where you want to be.

- Assess Your Financial, Estate, and Risk Situation: We review your current financial standing, including assets, liabilities, and income. Evaluate estate planning (wills, trusts, beneficiaries), taxes, and identify potential risks, such as being over-leveraged or experiencing a disability.

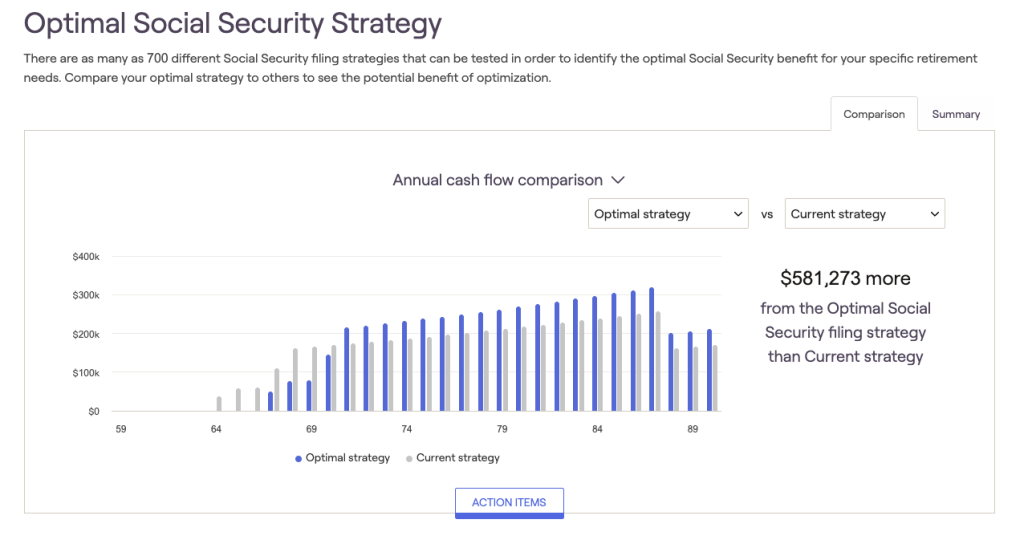

- Set Goals, Metrics, and Strategic Plan: We help you clearly define short- and mid-term goals, such as rental income targets or reducing time spent working, and track metrics like ROE, cash-on-cash return, and portfolio growth. We then develop a plan to allocate funds across real estate and other assets, integrating tax-efficient strategies to ensure progress towards long-term financial goals.

- Implement: Take Action and Track Progress Execute the plan by acquiring properties, setting up your estate, diversifying away or into real estate, or whatever else is needed to achieve your vision.

- Review and Adjust: Reassess and Adapt to Changes Throughout the year, financial, tax, and estate situations are regularly reviewed, making adjustments as needed (e.g., recommending selling underperforming properties or updating trusts) to stay aligned with your financial goals.

What is Real Estate Planning?

Real estate planning is a strategic approach to managing and protecting your real estate assets throughout your lifetime and beyond. We work with clients to determine when to sell a property, whether to perform a 1031 exchange, and model acquisition and disposition “What if?” scenarios to show the effect on cash flow and net worth with our modeling software.

Effective real estate planning encompasses a wide range of considerations, including property acquisition, ownership structures, tax implications, estate planning, and risk management. It requires careful analysis of your current situation, future aspirations, and potential challenges. Whether you are a homeowner or real estate investor, a well-crafted real estate plan can provide peace of mind and help you achieve your long-term objectives.

Why Choose Us for Your Real Estate Planning?

Unlike a one-size-fits-all approach, we offer personalized real estate financial planning backed by our experience with our own properties and assisting clients with theirs. We’ll navigate your unique goals, financial situation, and risk tolerance to craft a strategic plan for building wealth through real estate. If you are just looking to pick up a few properties to supplement your retirement or are building a real estate empire, we have assisted numerous clients with these goals. From investment property selection to ongoing cash flow management, we enable you to make informed decisions and assist with your goal of long-term financial security through smart real estate strategies.

Start Real Estate Planning Today with New Jersey Based Financial Advisors

Take control of your financial future with expert real estate financial planning from Sterling Adams Wealth Management. Whether you’re looking to optimize cash flow, reduce tax burdens, or protect your assets, working with a financial planner who understands real estate investing can make all the difference.

Schedule a no-obligation consultation today to explore how tailored financial strategies can elevate your real estate investments. Call us at (862) 261-5195 or use our contact form to get started!

Contact Us

Get In Touch

862-261-5195

155 Pompton Ave, Suite 203-1, Verona, NJ 07044

angelo@sterlingadams-wm.com